18+ years of experience building secure, scalable fintech systems.

At Teruza, we’ve developed and maintained multiple production-grade fintech systems — from advanced trading bots and arbitrage engines to secure KYC verification tools and integrations with leading banks. Our platforms are trusted to process millions, with zero incidents and a strong focus on compliance, performance, and adaptability.

We don’t just talk fintech — we build it, run it, and refine it every day.

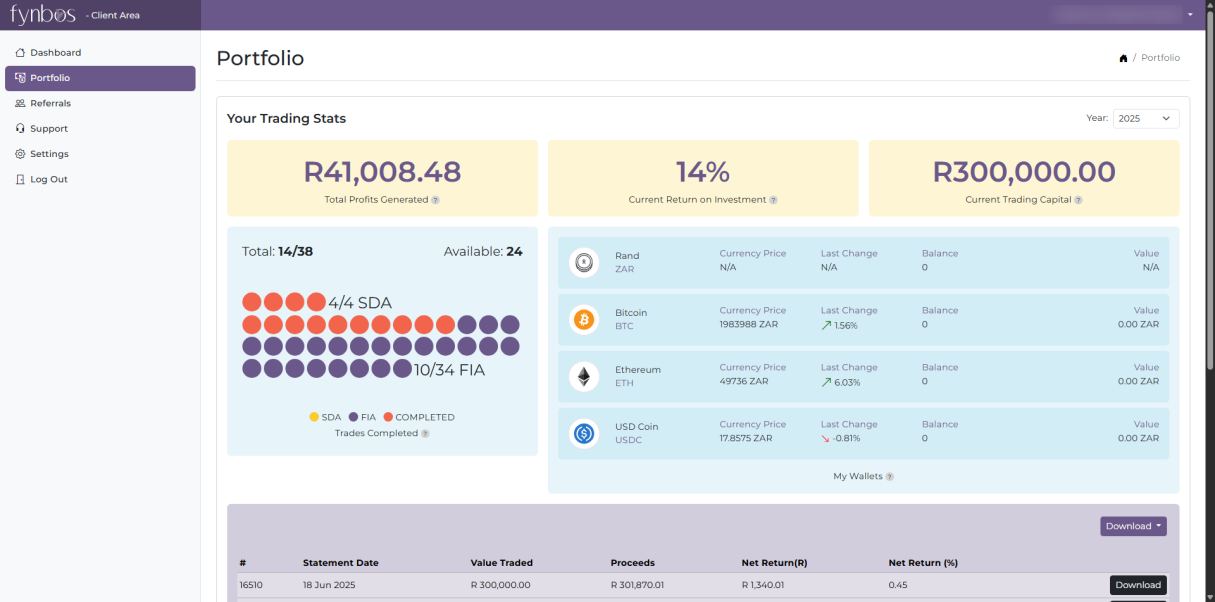

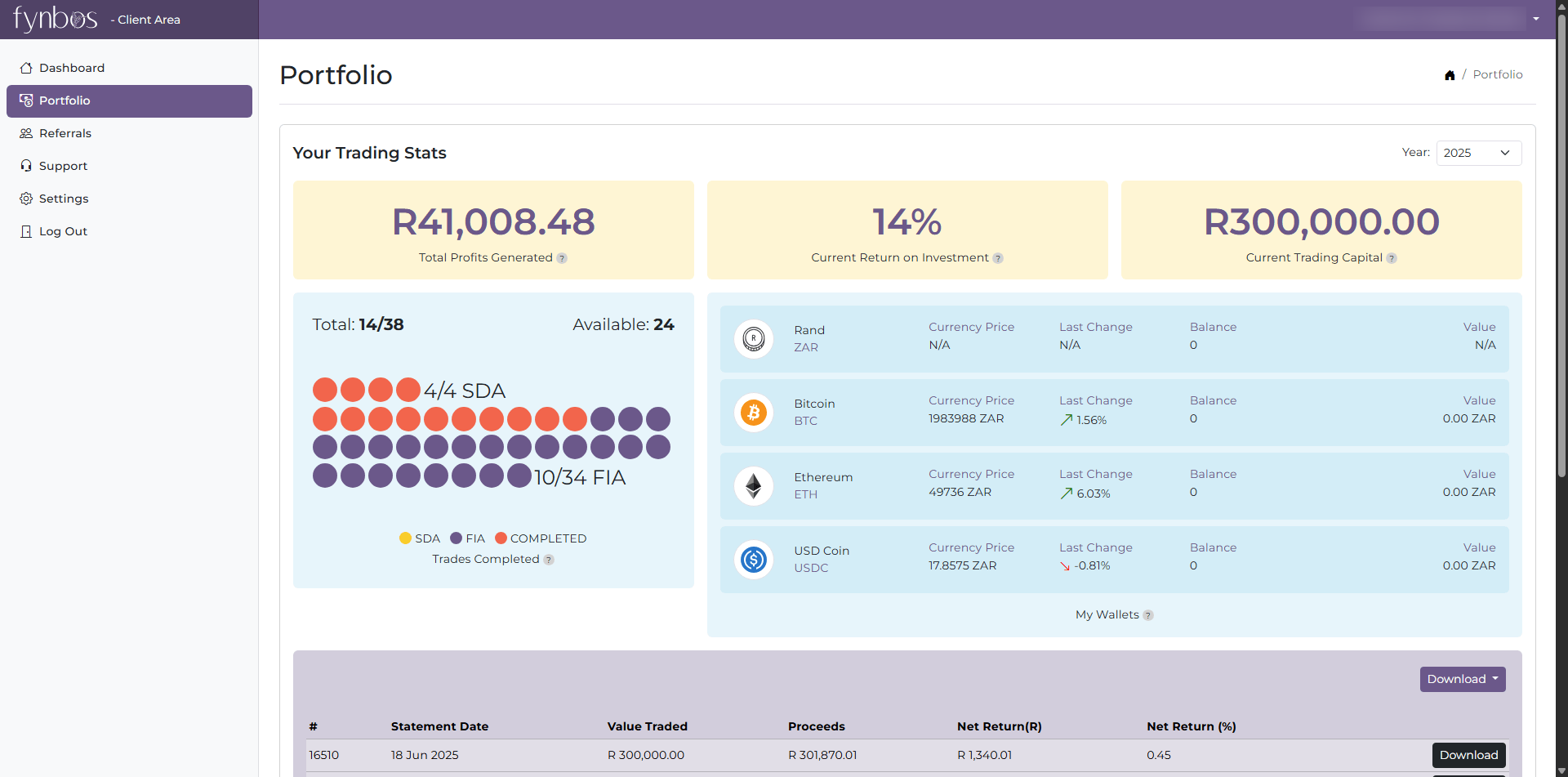

Battle-Tested Trading Infrastructure

Our team has architected and deployed trading systems tailored for both crypto and fiat markets. This includes high-frequency trading bots, arbitrage trading platforms, and automated trading engines built to handle real-world volumes.

One of our flagship platforms, Koinexpert.com, processed over R3 billion in trades across 2.5 years — with zero downtime or incidents. Whether you’re launching a basic trading interface or a sophisticated multi-exchange arbitrage engine, we can deliver a solution that’s fast, secure, and ready for scale.

Real-World Bank Integrations

Our systems integrate directly with some of Africa’s leading banks, including:

- Standard Bank

- Capitec

- Access Bank

- Investec

These integrations support real-time settlements, transaction monitoring, account verification, and more. We ensure bank-level reliability with audit trails and layered permissions for complete control over financial operations.

Built-in KYC & Compliance Toolkit

Teruza includes powerful KYC capabilities out of the box — from ID verification and selfie checks to sanctions screening and address validation. We’ve integrated with a range of KYC providers and also offer our own API-driven modules to cover nearly any compliance workflow.

Whether you’re dealing with FICA, AML, or other regulatory frameworks, our KYC infrastructure is flexible, extensible, and rock solid.

Modular, Scalable Laravel Architecture

All fintech solutions we build are powered by Laravel — one of the most trusted and extensible frameworks in the industry. This allows us to ship features faster, keep the codebase maintainable, and ensure long-term stability.

Need to add new features like loan management, crypto wallet integration, or multi-tenant support? Teruza’s modular architecture makes it painless.

Optimized for Growth & Custom Ownership

Our Enterprise license allows your internal developers to build on top of the system, while we provide the secure foundation. Many of our clients use Teruza as their core backend, customizing it as they scale — saving years of dev time while keeping full control over their roadmap.

If you're serious about launching or scaling a fintech product, Teruza gives you the edge — the code, the features, and the support to grow fast and stay secure.